richmond property tax rate 2021

Ad Search 1000s of Listings. Search Valuable Data On A Property.

City Of Richmond Adopts 2022 Budget And Tax Rate

TOTAL TAX RATE 335744 5583911 200874 1209658 966767 954517 419503 1922546.

. Tax Assessments Show Richmond Property Values Surging 7 3 Percent The Biggest Increase In A. 11506 Via Fontana Ct is a 5 Beds property in Richmond TX 77406. 2022 Tax Rates.

The city of richmond is not accepting property tax payments in cash until march 31 2021 due to pandemic safety measures. Ad Get In-Depth Property Tax Data In Minutes. The City Assessor determines the FMV of over 70000 real property parcels each year.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. This is the total of state county and city sales tax rates. Welcome to the official Richmond County VA Local Government Website.

Personal property at 29830 and motor vehicle at 13. Drury Plaza Hotel Richmond Richmond Va 2021 Updated Prices Deals. Overall there is a slight increase in real and personal property tax rate but.

Richmond City collects on average 105 of a propertys assessed. Ad Find Out the Market Value of Any Property and Past Sale Prices. The proposed tax rate is greater than the no-new-revenue tax rate.

The California sales tax rate is currently. City of richmond property tax bill. Such As Deeds Liens Property Tax More.

The rates for 2020 were real property set at 1772. This information pertains to tax rates for Richmond VA and surrounding Counties. Interest is assessed as of.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Town of Richmond 5 Richmond. Personal property taxes are billed annually with a due date of december 5 th.

Start Your Homeowner Search Today. We have done our best to provide links to information regarding the County and the many services it provides to its. Ultimate Richmond Real Property Tax Guide for 2021.

Millage rates are set by the authorities of each. 2021 Tax Rates for Entities Collected for by Fort Bend County Tax Office PDF Frequently Asked Questions PDF Taxpayers Rights. Learn all about Richmond real estate tax.

Tax Bill General Information. Tax Rate 2062 - 100 assessment. Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX.

Property tax payments may be paid by cheque bank draft debit card or credit card a service fee of 175 applies. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Tax Rate per 100 of assessed value Albemarle County.

This means that City of Richmond is proposing to increase property taxes for the 2021 tax. 1118 North 20th St. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

In Person at the counter Property Tax Payment Fees. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. What is the current tax rate.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February. View photos map tax nearby homes for sale home values school info. Personal property tax car richmond va.

Municipality of the County of Richmond 2357 Highway 206 PO. His projections suggest Richmond property values could hit a historic 63 billion by 2032 up from the latest re-evaluation for the 2021-22 tax year that pegged the total value of. Real Property residential and commercial and Personal Property.

A mill is one tenth of 001 or 1 per 1000 of assessed value. Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn. The minimum combined 2022 sales tax rate for Richmond California is.

Property value 100000 Property Value. The real estate tax is the result. Estate tax is the result of multiplying the FMV of the property times the real estate tax rate established by Richmond City Council.

Richmond property tax rate 2021 Tuesday February 15 2022 Edit. Debt rate for City of Richmond. One mill equals 1 of property taxes for every 1000 of assessed valuation.

The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. Tax rate information for property owners in Richmond Hill including how property taxes are calculated what are tax ratios and why property taxes increase.

Council Tax Band D Occupants In Richmond Borough Set To Pay Over 2 000 A Year After Inflation Rise Local News News Teddington Nub News

Council Tax Band D Occupants In Richmond Borough Set To Pay Over 2 000 A Year After Inflation Rise Local News News Teddington Nub News

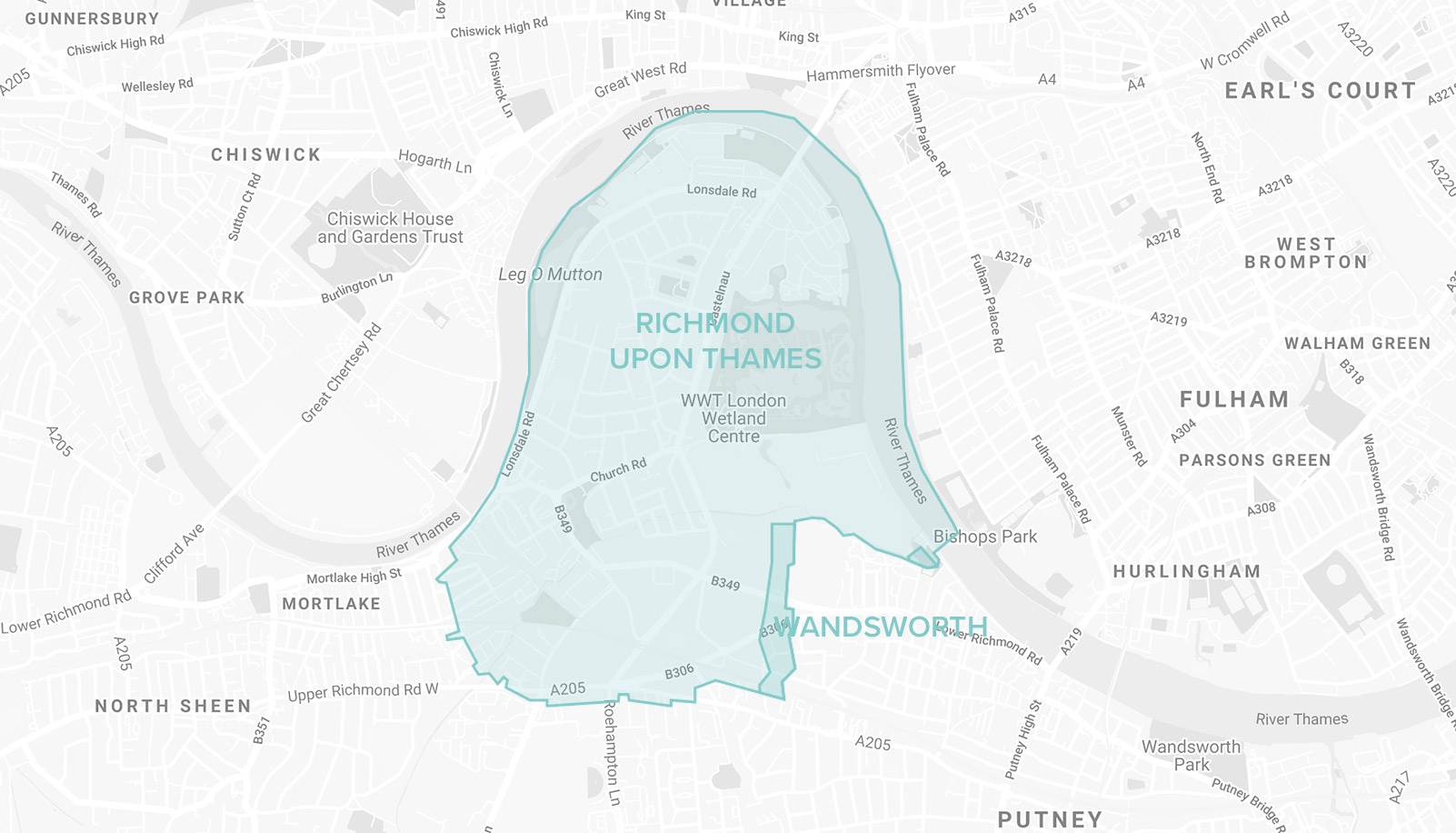

Richmond Council Tax Bands And Rates Marsh Parsons

Property For Sale In Cedar Terrace Richmond Tw9 Buy Properties In Cedar Terrace Richmond Tw9 Zoopla

Savills The Duke Public House 2 Duke Street Richmond Tw9 1hp Property To Rent

Eight Of The Best Georgian Properties For Sale Moneyweek

About Your Tax Bill City Of Richmond Hill

Richmond Monopoly Board Game Amazon Co Uk Toys Games

Vermont Property Tax Rates Nancy Jenkins Real Estate

Using His Luxury Horse Farm To Dodge Property Taxes Glenn Youngkin Is Sounding More And More Like His Idol Donald Trump Every Day Blue Virginia

Property For Sale In Ham Street Ham Richmond Tw10 Buy Properties In Ham Street Ham Richmond Tw10 Zoopla

Barnes Council Tax Bands And Rates Marsh Parsons

Richmond Council Tax Bands And Rates Marsh Parsons

Richmond Council Tax Bands And Rates Marsh Parsons

Richmond Council Tax Bands And Rates Marsh Parsons

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Soaring Home Values Mean Higher Property Taxes

Stamp Duty Holiday End Where London First Time Buyers Can Still Avoid Property Tax Evening Standard